Lifecycle transaction tools modernised for structured finance

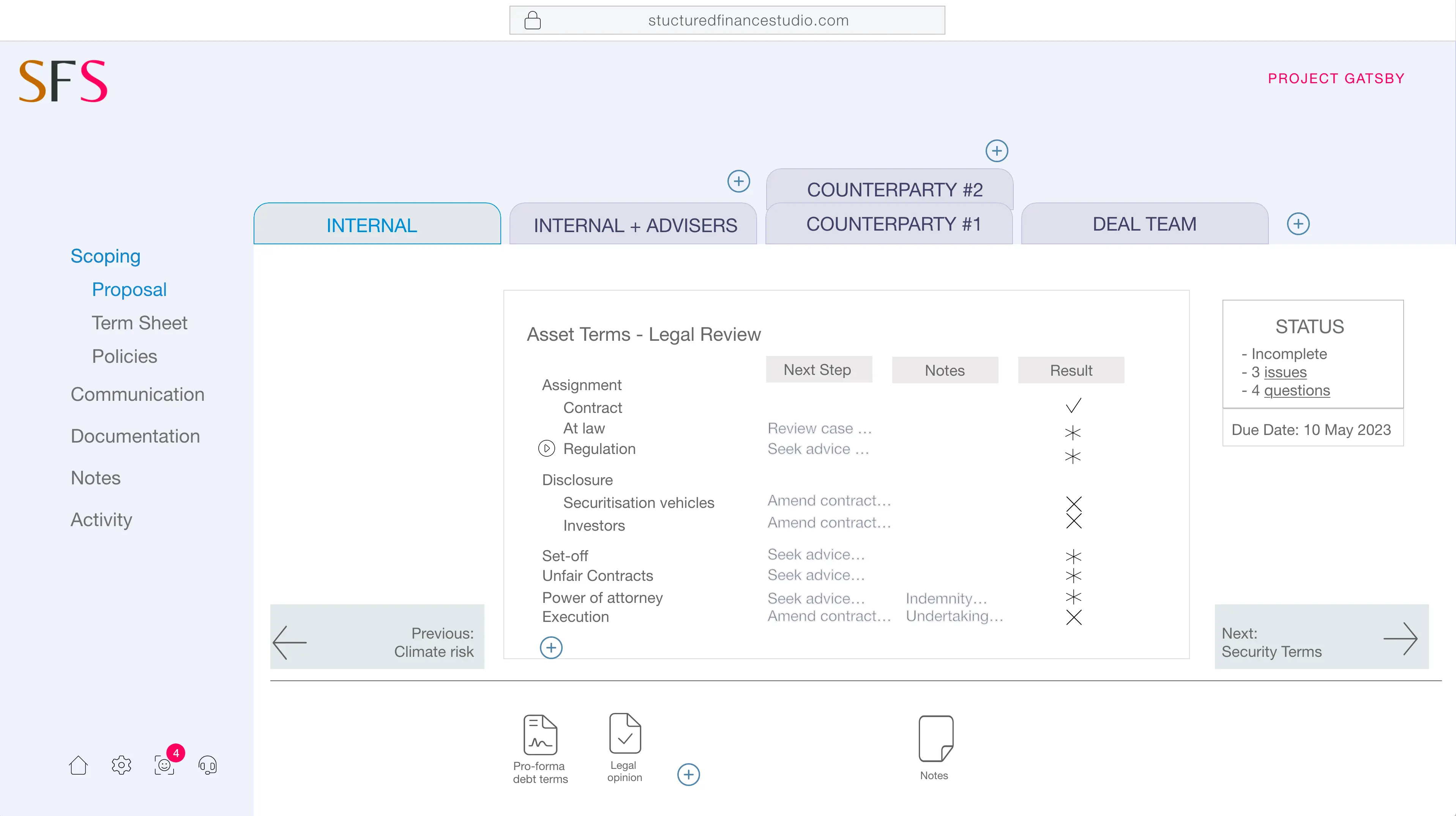

Effortlessly connect diligence with documentation, research and administrative control points and share relevant information with transaction teams, approvals committees and counterparties

Transaction development tools optimised to address the diversity of stakeholders and governance structures and shifting regulatory landscape within the debt capital markets

Asset DD

Due diligence checklists & risk mitigants

Term Sheets

Customisable, annotated termsheets

Documentation

Documentation platform to streamline transaction negotiation and documentation

Policies

Policy DD checklists and templates

Profiles

Assess opportunities against preferred credit and legal positions

ESG

Pathways to integrating ESG

Visualiser

Data informed visuals depict transaction structures and features

Market dynamics

Curated artifacts from across the web, in your deal newsfeed

Securitise That!

Breakdown the anatomy of featured deals, from the vanilla to the exotic

Credit

Tools to assess and vet funding avenues

Meet Cam

An armchAIr quarterback trained to support deal execution teams

The transaction planning, structuring and execution platform for securitisation

Reflect credit policy, historical and preferred positions, asset-class variables, market dynamics and transaction participant profiles into deal terms and internal and external deal portals.

Specify features by asset-class and flag them against relevant deal points and mitigants. Add them to deal proposals, term sheets, policies, issue lists and credit papers.

The tools you need to close the transactions you want

Standardise and share best practices and processes with preconfigured workflow templates that reflect your instititional knowledge, transaction history and prefereces so that your team can effectively manage deal flow.

Documentation

Intuitive transaction tools

Generate customised checklists for diligence, credit or legal review, and points to be referred to relevant advisers. Track progress by tagging the issue to requests for materials, transaction documents, approvals and other requirements.

Positioning

Enriched benchmarking

Benchmark positions against house-preferences, market insights, and transaction terms and analysis from team members, precedent deal books and from public sources.

Development

Focused engagement

Identify issues and manage them with internal, and exerternal team members, and counterparties and tag feedback to related documents or decisions. Use the issue tickets to generate issue lists, approval requests or internal notes for transaction management.

Intuitive transaction tools

Generate customised checklists for diligence, credit or legal review, and points to be referred to relevant advisers. Track progress by tagging the issue to requests for materials, transaction documents, approvals and other requirements.

Enriched benchmarking

Benchmark positions against house-preferences, market insights, and transaction terms and analysis from team members, precedent deal books and from public sources.

Focused engagement

Identify issues and manage them with internal, and exerternal team members, and counterparties and tag feedback to related documents or decisions. Use the issue tickets to generate issue lists, approval requests or internal notes for transaction management.

Register to get started

Design your policies with industry, region or business risks in mind and customise them to address stakeholder feedback

Get startedThe Sizzle

Subscribe to The Sizzle to get notified when we open our doors, and in the meantime we share news and issue reviews that have informed the feature specifications used to build the the SFS tools.

We don't share your email with anyone else, and you can unsubscribe at any time. Read it first.

Frequently asked questions

If you can’t find what you’re looking for, use the chat-bot to ask a question and we will get back to you.

Which asset classes are templated?

We started with aircraft leasing, insurance premium and advanced market commitment funding. We are just getting started. We are developing template frameworks for the vanilla and the exotic. Please get in touch if you would like to collaborate with SFS in developing the template libraries that we will use as our base framework. At this stage, are working with our beta participants to guide these priorities.

What if my deal team is firmly committed to email and word?

We can choose not to live like it's 1999. The work you're producing in word documents and emails is transformed into recyclable artifacts in a continually developing data loop - if you can make the leap. We are working on a way to import your existing positions and deal terms into the platform. In the meantime, you can use SFS to develop new deals, positions, policies, credit-papers and reports.

Does SFS certify templates and frameworks as lawfully compliant?

No. You can add your debt, legal and tax advisers to your deal books to help you develop your materials for your purpose. When you do, you will be capturing rich data that informs the profile of the advisers you engage and the positions as they develop. These can then be tagged to DD checklists, deal documentation, and reporting templates. They will also be embedded in your profile history, so the insights can be reused in future deals.

Is my data fodder for the SFS research library?

When you use SFS, the digital information you create is your private information. We respect that and will not use or share it unless you invite or permit us to do so. You can choose to give us tiered permissions, so that any anaylsis we perform, can only be used to share insights within the disclosure settings you specify. There are some technology products that work better when they know some information about you, like your deal preferences, constraints and legal or commercial views on different kinds of risk. By allowing us to collect some of your data and use it as part of an aggregated data set (sanitised and anonymised), what is shared is a set of benchmarks that can inform your judgement. We collect data within the controls that you agree are reasonable, and aligned with your expectations. We offer controls that allow you set boundaries around data collection and give you ownership of your data. We also give you transparency around how your data is used. If you share information, you can use your settings to set limits on how SFS can use it. We value data portability and are thinking about integrations that will allow you to export your data from SFS - for now that is not a feature on our immediate roadmap.

How does blockchain fit in with this?

In 2020, Figure announced the first securitisation backed by loans originated, serviced, financed and sold on blockchain. This, along with Brightvine's 2022 securitisation (in partnership with Angel Oak Capital) inspired our sandboxed test transaction. It's in an 'alt' market and seeks to capture the efficiency, integrity and transparency gains that blockchain offers. We will say more one day soon, but for now, we'll say that we've built this with decentralised, immutability in mind.

How much does this cost?

We are in development. Pricing will be informed by feedback received from our beta participants.

What forms of communication are supported?

Your studio has interfaces for your internal and transaction teams. Customise the tabs to add your colleagues, advisers and counterparties to relevant layers, so you can raise and deal with issues, tagging relevant documents or diligence points as you work through points. Generate bespoke issue lists that summarise status, for that group.

What is the difference between a deal book and a deal team studio?

A deal book is a collection of documents generated for a deal and shared at deal team level - this would typically include final transaction documents, closing checklists, CPs, amending documents and notices. A deal team studio is a collection of positions, policies, credit-papers and reports for a deal. Your deal team may want to keep the studio content private, and then use it to assess deal positions against that content.

Is SFS SOC2 certified?

No, but we are working on it and aim to be certified before launch. Our layered security model is built with security and data stewardship at the core. Review the design principles used to build the platform in the Policies section of the website.

Do I lose my transaction data if SFS stops paying its server costs?

Mostly. You probably don't want that to be the answer. It's on our road map to see what we can do to give you something better than a pdf dump that you can use to back up your transaction documents in your own database. For now, we're just getting started and we'd like to figure something out to give you a better answer. Stay tuned as we work on this.

Who is Cam?

The Sage of Securitisation. Google has Claude and Bard. SFS made Cam to provide sourcing and citations in AI-powered, live, search-driven analysis to support your deal structuring, execution and ongoing management. When you interact with Cam, your settings will determine how much reach into your deal books inform those results. They are otherwise complemented by market, industry and stakeholder artifacts from a range of public and private sources. Cam is a work in progress, and we are working on a more robust personality model. The training wheels are still on. You can use the voting buttons you see to let us know if you appreciate the contributions that Cam is sharing or otherwise.

How does Cam use generative AI?

For now, Cam's learning. You can set parameters within which you're comfortable allowing Cam to train on your transaction documents. Cam's capability roadmap is shared in the sandbox. Cam is starting with a small task, which is to check a single diligence point that ususally forms part of the boilerplate of a suite of transaction documents. The goal will be to provide you with a list of the questions that Cam asked and answered, together with the sources of information used to give that answer. The idea is that you can let Cam have the first go at performing the diligence and reporting back to you, and then use your own efforts to correct or complete the response.

How does SFS promote accountability?

The transparency, and legacy of past deal terms and decisions on key positions demonstrates how investment, treasury and asset management decisions are made, over time. Attract compatible sponsors, investors and advisers by reference to the quality of deal metrics, set against prevailing market trends.

Do I need to disclose confidential, proprietary information to use SFS?

No. Your deal books are your own. However, SFS augments your deal capability with rich analytics that you may choose to use (in summarised, sanitised form) to flag a position taken on a transaction. You can use that for internal purposes (such as sign offs against preferred positions) or external purposes (such as benchmarks against proposed standards). You can also choose to post your comments and insights to the SFS research database, where they will be available to the wider community - within the disclosure boundaries you specify.

How does SFS promote continuing professional development?

Members can tag content that has been shared on the platform, with notes that address sub-optimal commercial, or legal practice, and recommend a consistent framework against which practice can be improved. Use the disclosure settings to control the visibility of your comments, or share them broadly to encourage the discussion and adoption of your view.

How do I invest in my personal brand?

If you are permitted to do so, posting your ideas, views on positions, protections and optimisations is a competitive investment in your personal brand. The SFS research database is comprised of actionable insights contributed by established and emerging leaders in the field. Endorse or criticise them to develop the thought.

In what order are you building templating engines?

That's guided by our participants. At the moment, we're working on aircraft leasing, microbial resistance, YouTube creator catalogues and green-auto. RMBS is starting soon. Get in touch if you'd like to work with us in developing these templates and to share your suggestions for our prioritisation.

How do I get my deal team on SFS?

We're currently in private beta with a small set of participants across a range of asset classes, investor profiles, regulatory regimes and jurisdictions and advisers. We're working toward announcing a public launch later in the year. If you'd like to be involved, please get in touch.

What is the sandbox?

It's a playground for transaction structuring. We use it to build out demos of structures that we think could enhance a feature, transaction or asset exposure. We test structures in the sandbox. Invitations to join the sandboxes are managed via your dashboard.

Can I provide feedback?

Yes please. Your comments will help us to improve. There are channels in the discord for feedback on the roadmap, the platform generally and the asset classes, credit, legal and structuring issues we review. Thank you.